Credit cards & how they work

Credit cards offer consumers a number of benefits, including the ability to borrow money and earn rewards. However, choosing the right business credit card can be difficult.

Best Business Credit Cards

Here are Best Business Credit Cards And five factors to consider when choosing a business credit card:

Things To look When Choosing A Credit Card For Business

1. Annual Fee.

The annual fee is the most important factor to consider when choosing a business credit card. Some cards have very high annual fees, while others have lower fees.

2. Rewards Program.

Many business credit cards offer rewards programs, such as points that can be redeemed for rewards, such as cash back or travel rewards.

3. Interest rates.

Interest rates are another key factor to consider when choosing a business credit card. Some business credit cards have low interest rates, while others have higher rates.

4. Redemption Options

Some business credit cards offer redemption options, such as rewards that can be redeemed for items such as gift cards or merchandise.

5. Credit Score.

A business credit card may not be appropriate for everyone.

Best Credit Cards For Business

There are a few Best Business Credit Cards for business and travelers, so it can be tough to generalize when it comes to what the best credit cards for business travelers are.

However, we’ve put together a list of five of the best cards for those who are always on the go and need to manage their expenses.

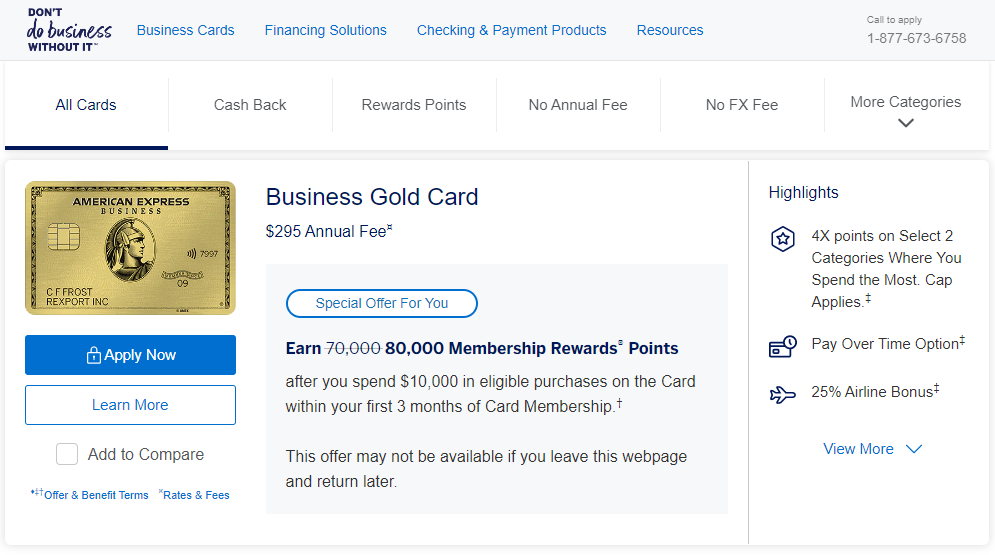

1. American Express Business Platinum Card

This card offers great benefits for business travelers, including a 50% bonus on eligible spend, reimbursement for travel expenses, and more. It also has an excellent customer service team, so you can always count on them if you run into any problems.

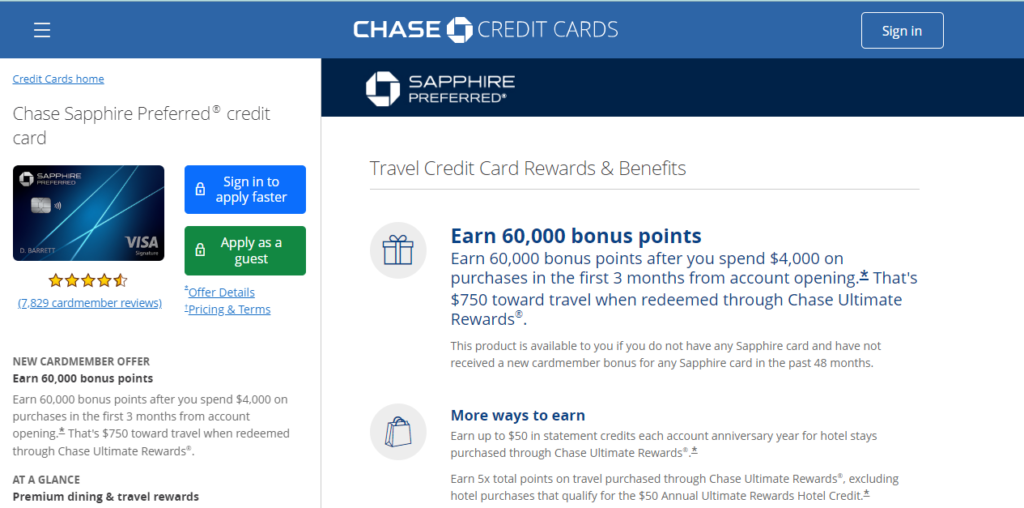

2. Chase Sapphire Preferred® Card

This card is perfect for business travelers who want the best of both worlds. It offers great benefits, like a 50% bonus on first year spend, but it’s also Chase’s highest-rated card, with a stellar rating of A+ from the Better Business Bureau.

3. Wells Fargo Active Cash® Card

The Wells Fargo Active Cash® Card is an excellent way to earn cash back on your purchases. You can earn 2% cash back on all your purchases, which can really add up over the course of a year.

Plus, there are no annual fees, so you can keep your money locked away in your account without any extra costs. The Wells Fargo Active Cash® Card is a great way to get your spending under control and earn some extra money.

4. Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards Credit Card is a great way to get rewards for your spending! With this card, you can earn miles and points for every dollar you spend, which can be redeemed for rewards like travel, shopping, and more.

Plus, the card has a low APR and no annual fees, so it’s a great option for anyone looking for a cost-effective way to get rewards. So if you’re looking for a card that will help you earn rewards for your spending, the Capital One Venture X Rewards Credit Card is the perfect option!

5. The Platinum Card® from American Express

The Platinum Card from American Express is the perfect way to enjoy all the benefits of American Express Membership Rewards. With this card, you can earn rewards for every purchase you make, including travel, dining, and entertainment.

Plus, you can use your rewards to get free domestic US flights and get free admission to some of America’s top attractions. With the Platinum Card from American Express, you’ll be able to enjoy a great lifestyle without breaking the bank.

Credit Cards Instant Approval

Do you have a credit card and are you constantly waiting for the approval process to start?

The approval process can take anywhere from a few hours to days, depending on the card company. And even if the card is approved, you may still face some problems.

Here are a few tips to help you make the approval process easier:

- Make sure you have your financial history and credit score updated.

- Make a list of the completed tasks that need to be done in order for the approval process to start.

- Be prepared to wait.

- Be patient and understand that the approval process can take a long time.

Credit Cards In Uk

Credit cards are a popular way to manage your finances, and they’re also a great way to build your credit score. Here’s a quick guide to using credit cards in the UK:

1. Make sure you have a good credit score. If you have a low credit score, you may not be approved for a credit card. You can improve your credit score by paying your bills on time and using a credit monitoring service.

2. Choose a credit card that’s right for you. You may be approved for a credit card if you have a good credit score, but you may not be approved for a card with high interest rates or a limited credit limit.

3. Pay your bills on time. If you don’t pay your bills on time, your credit score may decline.

- Use your credit card responsibly. Don’t use your credit card to buy things you can’t afford or to spend more than you can afford.

Credit cards for college students

Credit cards for college students can be a great way to improve your credit score and build up your credit history. They can also be a great way to get access to emergency cash when you need it, and they can help you build a credit history so you can get better loans in the future.

To get the most out of your credit card, make sure you use it responsibly. Pay your bills on time and keep your balances low. You also want to make sure you understand the terms and conditions of your card before you use it.

There are a number of credit cards available to college students. Some of the most popular cards include the American Express card, the Mastercard card, and the Visa card. Each card has its own set of benefits and drawbacks, so it’s important to choose the right one for you.

Once you have chosen your card, make sure you understand the terms and conditions.

Advantages Of Using Credit cards

There are many reasons why people might choose to use credit cards, and many of those reasons are especially relevant to those who are looking to build or maintain a good credit score. Here are five key advantages of using credit cards:

- Credit cards offer a way to build or maintain a good credit score.

A good credit score is important not only for your own financial well-being, but also for your ability to get loans and other credit products in the future. By using a credit card responsibly, you can help build or improve your credit score, which can make it easier for you to get the credit you need.

- Credit cards offer a way to get instant access to funds.

Many credit cards offer the ability to withdraw funds – often instantly – from your account. This can be useful if you need money to cover a short-term financial need, such as paying for groceries or fuel.

- Credit cards offer a way to save money.

Best business credit cards for travel

When it comes to travel, it can be hard to decide which business credit card to choose. Thankfully, there are a few cards that are great for travel, and they all have different features that can make your trip easier.

One of the best business credit cards for travel is the Chase Sapphire Preferred. This card has a high rewards rate, and it also has a travel credit card backup feature. If you have travel expenses that you can’t pay off right away, the card will help you get the money you need to cover those costs.

Another great option is the American Express Platinum Card. This card has a high rewards rate, and it also comes with a travel assistance feature. This feature can help you book your trip, get travel insurance, and more.

If you’re looking for a card that has a low rewards rate, the Chase Ink Plus card might be a good option for you. This card has a low rewards rate.

Also Read – 15 Best ways to make money online in Nigeria