we’re going to answer one of the common questions we get from newer traders and that question is what are the key differences between day trading and swing trading and which one is right for me and my current situation.

let’s go ahead into the meat and potatoes of this article

DAY TRADER VS SWING TRADER

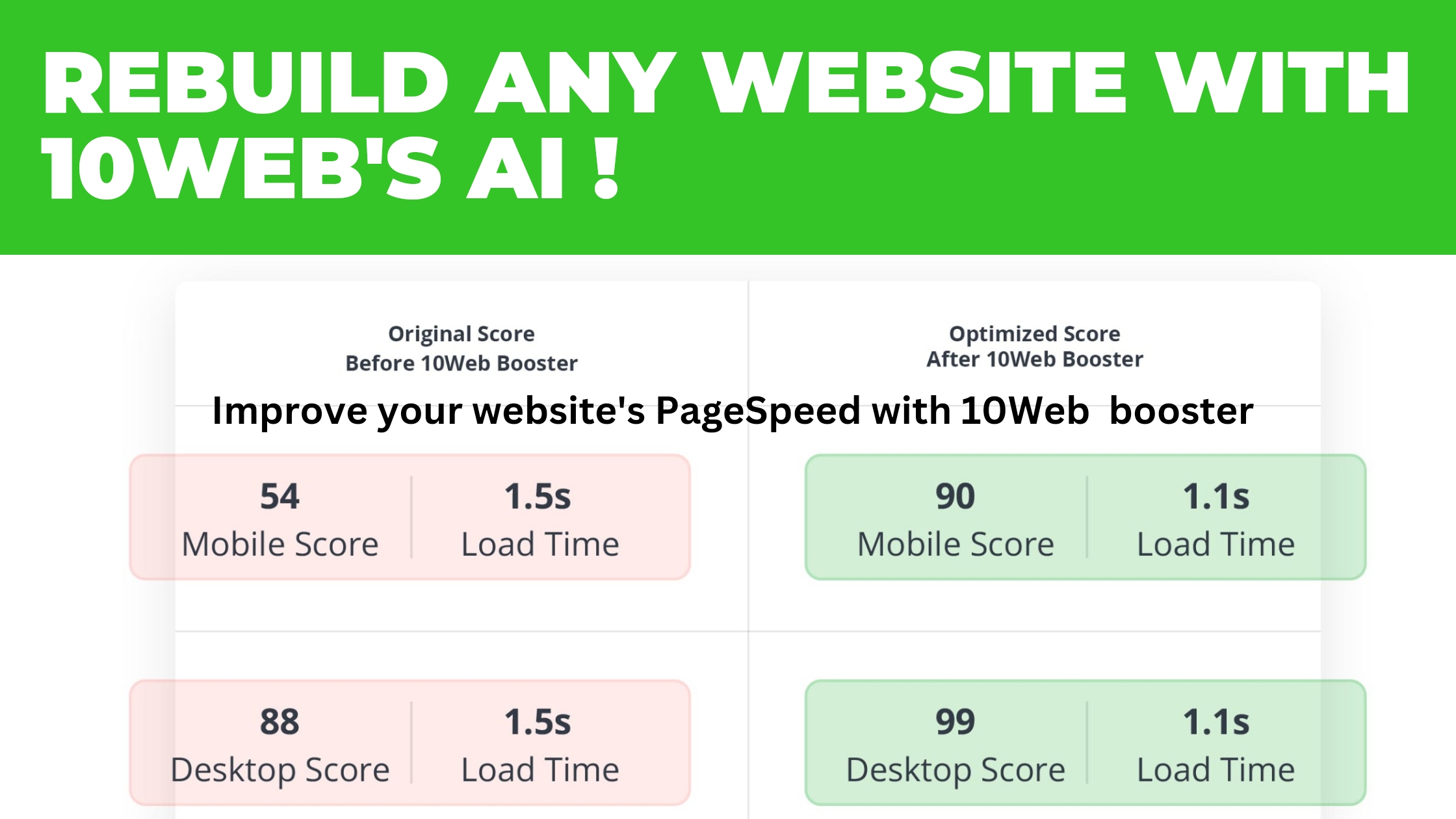

Here is a little grid that we’ve gone ahead and put together with regards to some of the key factors that are different between the day trading style and the swing trading style. these factors are the holding period to trade frequency the commitment the time commitment required for each style the risks associated with both styles some of the costs associated with them.

the profit potential and the personality type this is basically what type of personality is best suited for each style of strategy. let’s go ahead and get started with the first one that is the holding period

HOLDING PERIOD

as a day trader as the name would imply you’re looking to get in and out of trades on the same day your holding period is intra-day. what that means is you start the session in cash and you try to end the session in cash ideally with more in

the account than what you started the day with that’s the whole purpose of day trading it’s to make consistent income to make distant cash flow and as a result of this style of trading the holding period will be anywhere from a couple of seconds to a couple of minutes can even go up to an hour or two but your holding period will generally be under six hours which is typically a trading session.

How long should you hold a forex trade ?

as a day trader, you’re going to be holding and getting rid of those positions intraday whereas as a swing trader you’re going to be holding trades anywhere from one day up to several weeks. as a swing trader you’re generally looking for larger moves whereas a day trader is looking for intraday moves a swing trader will be looking for a longer-term kind of movement and as such the trades will take a little bit more time to develop and play out and that’s why the holding period is a little bit longer than a day trader

that being an overnight hold up to several weeks alright so swing traders as you guys can see from the first example these guys are a bit more passive in their approach they’re not getting in as many times and that’s because they’re looking for larger positions.

TRADE FREQUENCY

Trade frequency is simply how many positions you’re gonna be taking daily every month and as again the name would imply a day trader is going to have more trades than a swing trader on a daily basis and also every month so for day traders they can make anywhere from 5 to even hundred trades per day. day traders the main difference between the two is that day traders they’re able to take this many positions because they’re generally looking for smaller moves.

they’re looking for smaller price fluctuations to capitalize on and as a result their risk-reward file also tends to be a little bit tight what that means is a risk-reward profile of saying one point five to one or even one to one is quite common for day trading strategies and what that means is for every dollar that you’re risking you’re looking to make a dollar fifty

you know two dollars in the case where it’s one to the one you’re looking to make one dollar while you’re risking one dollar so day trading strategies tend to be a little bit of a higher strike rate meaning you’re going to write more times than not and as a result of a higher strike rate you’ll likely have a lower risk-reward profile and being able to catch multiple small price fluctuations daily is what this strategy is all about so 5 to 100

you won’t necessarily be going towards this side you’ll be leaning more towards the lower end of that side as a day trader alright where is a swing trader because they’re looking for larger moves and because their holding period tends to be longer they’re going to have fewer trades every month.

a swing trader when trading their strategy and filtering out the non-quality setups will have anywhere from five to ten trades every month and again this kind of drives back towards the risk-reward profile of these because they have fewer trades every month and they’re looking for larger moves than day traders are swing trading risk-reward profiles tend to favor higher

risk reward which also means a lower strike rate so while swing trading strategies tend to have a lower strike rate meaning you’re going to win less than you’re going to be rather you’re going to be losing more often than you’re going to be winning which is okay because the risk-reward profile tends to be most commonly three to one which means that a swing trader will often

risk a dollar to make three dollar gain alright so you guys can see whereas day traders they’re looking to capture smaller moves they’re looking to get a higher strike rate and they’re looking to use a lower risk-reward profile whereas a swing trader they’re going to be looking to take fewer trades for bigger moves so the risk-reward profile is going to be greater and that means that their strike rate is often gonna be lower than that of a day trader all right.

TIME COMMITMENT

the time commitment for a day trader is a minimum of two hours a day. the reason why you need a minimum of two hours a day is that you need time in front of the screens to scope for opportunities you need to take those opportunities you need to manage those trades while you’re in them all right and you’ve got to keep scanning for more opportunities.

so it’s a rinse and repeat kind of a cycle and it’s gonna take at least two hours a day. as for me, I like to trade for two hours I like to trade the US cash open into the European cash closed 9:30 a.m. till around 11:30 a.m. Eastern Time as well so minimum two hours a day someday traders like to trade from open to close 9:30 a.m. to 4:00 p.m. that’s not necessary you can still make a full-time income with only two hours a day

but your time commitment you’re gonna need to have those hours in front of the screen so this is more applicable if you have the freedom of schedule you have flexibility in your schedule to sit in front of the screen for those two hours of the session for at least the cash open all right if you have that time flexibility or you want

to do this full-time you’re gonna need to have those hours available to do that successfully whereas a swing trader they’ll only really require you know 30 minutes a day minimum to trade that strategy successfully and the reason for that is because a majority of your analysis for swing trading for the week going forward

can be done on the weekend when the market is closed so when the market opens up for the coming week a swing trader will just keep an eye on you know the pairs that they’re watching or the stocks that they’re watching and they’re going to set their orders to see what gets triggered what doesn’t get triggered and all they need in those 30 minutes is to place new orders

and to manage existing orders so you’re not really looking for too much a majority of your opportunities you already know what you’re looking for or before the market even opens so throughout the week you’re gonna need maybe 30 minutes just to update those orders and to set new ones so the time commitment as you guys can see as a swing trader it’s a lot more passive

than day trading and what that means is that if you hold a full-time job a nine-to-five and you’re not able to sit in front of the screen for those at least two hours, a day swing trading is a viable alternative for you to still be active in the industry you know while adjusting to your schedule while making the market work within your actual schedule. that is the time commitment between these two strategies.

Also Read – Top 8 Best forex trading platforms Australia – Top 10 Super Forex Trading Chart Patterns: Every Trader Should know, 2022 – Forex Trading For Beginners UK : Everything You Need To Know 2021

RISK

as far as risks are associated with day trading the main risk associated with day trading is daily volatility and what I mean by this is that daily volatility is important for day traders to love volatility but volatility is a double-edged sword alright if there’s no volatility in the markets on a certain day you’re not going to be as aggressive not trying to make daily profits you know not trying to get the full daily profit at least whereas if there’s good

volatility you’ve got an opportunity to make your daily profits and then some all right that being said you know since 2016 since Biden was elected he’s been very vocal on Twitter and what that’s resulted in is some unexpected volatility so day traders love volatility that’s to be expected and what I mean by that is when you’ve got events such as FOMC such as FN FP anything high-impact like that that’s scheduled where you’re anticipating volatility to come into the market as a result of that schedule

great event but with Biden and with his you know the Twitter fingers what can happen these days is you know Biden can go in say something all of a sudden you know market whips up or market shoes lower and let’s say you’re qualified to trade let’s say you’re in a trade long and then Biden goes ahead and tweets out that he’s canceled talks with President with regards to the us-china trade war all right markets gonna dump you’re gonna get stopped out of that trade and there’s nothing you can do about that all right and so that’s one of the risks associated with day trading

that daily volatility whereas with swing trading the risks aren’t so much in the daily volatility they’re more so in overnight and weekend gaps and so this isn’t something that you often see in markets that trade throughout the week such as futures such as Forex such as commodities but this is something that you will often see if you trade stocks or if you swing trade ETFs

where the market closes throughout the week and then reopens the next day right you can be exposed to overnight gap risk and so what overnight gap risk means is simply that when the market closes let’s say that you’re long let’s say Facebook you’re long Facebook and then as the markets closed there’s a bug report that drops such as the Canberra Jana political scandal right where it’s a negative report it’s a very negative report right

and what’s likely to happen is the next morning when the stock market opens up that stocks likely gonna gap down lower right and so if you were long that stock before the market closed on the market open when it gaps down it doesn’t matter whether your stop is you know up there.

it is doesn’t matter whether your stops up because the markets gapped down you’re gonna get taken out at that lower price you’re not gonna get taken out at your stop-loss all right so that’s one of the risks associated with swing trading stocks and ETFs is that overnight gap risk that being said you

know there is also weekend gap risk so those traders that are in Forex commodities and even futures are not immune to this kind of risk and a good case in point is the crude oil gap that happened about two weeks ago now when the Saudi or Saudi Arabian oil field was bombed by some drones which took out a good chunk of production a good chunk of supply from

the oil market and what happened as a result of that is when the futures opened up on Sunday morning the crude gap and set alright so 10% gap up from Friday’s sessions clothes so if you were short into Friday and Sunday happened Sunday open and the futures gapped up again

Gape market chart

you’re not gonna have your stop-loss honored because there’s no traded volume out there everything’s gapped up so you’re gonna take a larger loss than anticipated and that’s one of the risks associated with swing trading is that overnight and that weekend gap risk all.

right so now let’s dive down to the costs

COST

as you guys can see on here the costs associated with day trading are more expensive than swing trading and the reason for this is because day trading software the software used by day traders is a lot more sophisticated than what swing traders need a lot of day traders to utilize order flow tools which means

that you need advanced order flow packages a lot of day traders also require new squawks which means you got to subscribe to a new squawk alright so all of these things combined can add up to quite a lot and another thing that will add up is also Commission’s so as you guys can see on the frequency tab over here 5 to 100 trades per day you

know will add up the more trades you’re taking the more Commission’s you’re paying and the higher your costs increase alright so as far as the software perspective day trading is more expensive and as far as a commission you know the cost of doing business perspective day trading is also more expensive because you’re going to be taking more trades whereas with swing trading the costs as far as software is a concern is less expensive because you don’t need as sophisticated a tool as you do for day trading all right with swing trading all you need is candlestick charts

you know simple software package that can offer candlestick charts volume profile you know regular volume moving averages some indicators like that if you need those but what swing traders need is a lot less intensive than what day traders need which means it’s cheaper all right so you can get away you can rather get by with a nice software package and that offers you know regular charting

as long as you have a price chart as long as you have volume and volume profile that’s all you need as a swing trader to succeed on top of that because you’re not making as many trades on a monthly basis instead of taking five to 100 a day you’re gonna be taking around five to ten a month okay and so as a result of that you’re going to be paying less in commissions than you would as a day trader making swing trading the less expensive option to start with.

Profit potential

let’s get down to the profit potential so as far as profit potential is concerned it depends on the actual trader all right day trading versus swing trader if you have a crappy day trader and you have a good swing trader the swing trader is gonna make more money so this one is more reflective or relevant to the actual traders but as far as compounding positions and the and the probability of doing so that happens to favor the side of day trading.

the reason that is is that you’re gonna be making more trades every month as a day trader than you will as a swing trader and what that means is that you’re going to be taking more trades your Edge has a better chance of playing out within the month than as a swing trader who’s taking fewer trades so what that means is even though your wins are gonna be smaller than what a swing trader would be you know targeting because you’re the frequency of your wins happens a lot more throughout the month than the swing trader that compounding effect is going to take account a lot faster as a day trader all right

whereas a swing trader you’re still looking for profits you know swing traders will look for smaller moves looking to make 5 to 10% on our position alright and as a result of that the compounding is still there but it comes out of slower pace than what you would see from a day trader alright and finally into the last section of this presentation here the personality type so which personality type bodes well with each strategy so as a day trader you’ve got to be decisive you’ve got to be patient you’ve

got to be diligent and you’ve got to be mentally tough all right a day trader if you’re looking at personality a and personality B types a day trader would be the personality a type all right these are the type of people that would be competitive they tend to work well under pressure. they tend to be decisive under pressure they’re able to flip their bias on a dime. they’re able to make split-second decisions if this sounds like you then

day trading would likely be better suited towards your personality than a swing trader whereas for swing trading what you would have is more reflective of a type B personality which means you’re a bit easier going this isn’t saying that

you’re not also patient you’re not also disciplined right you’re not also diligent you’ve got to be all of those things but a swing trader has a more easygoing, more passive approach towards the markets. they don’t want to be in a situation where they got to make split-second decisions right if you take a loss on a swing trade you’ve got time to look for other opportunities to set those trades were as a day trader if you take that loss right away you’ve got to be able to say all right is my bias

still valid if not I gotta flip my bias I got to start looking for Long’s instead of shorts etc so the day trading personality is a lot more aggressive if you will than a swing trading personality so depending on what type of personality you are as we just mentioned you’ll either fit into the day trader or the swing trader style of trading.

CONCLUSION

this article with regards to the key differences between day trading and swing trading. I do hope that this article is a little bit more insight into the differences between the two strategies and helped you kind of define which one is better suited for you. at this point now that being said what we often say is a good day trader will make a great swing trader whereas a good swing trader doesn’t necessarily mean that you’re going to be a great day trader alright and the reason for this is because a day trader you’re looking at the smallest price

fluctuations and as a swing trader you’re looking at larger price fluctuations all right so as you start you can choose one of these styles to start with all right and then you can kind of mesh the two and that’s typically what we see is most people will start as swing traders as they get more experienced in the markets as they start making money then they start venturing towards day trading and the reason we like day trading is because you can essentially come from a swing trading background get into

day trading and then you can start and take trades starting them off as day trades and then utilize your experience as a swing trader to extend those profit targets and take a day trade to start and extend that into a swing trading

the position that is really where the money is made in these markets if you can start a day trade with very tight risk and take profit as if it was a swing trade you know that’s going to be a lot more than a three to one kind of risk-reward profile so I hope you guys enjoyed this article thank you for your time stay blessed.

Also Read – Top 8 Best forex trading platforms Australia – Top 10 Super Forex Trading Chart Patterns: Every Trader Should know, 2022 – Forex Trading For Beginners UK : Everything You Need To Know 2021